Fishing Trip Cost Types

Fishing Trip Cost Types are used to identify the cost factors associated with a fishing trip. The costs registered here can for example include items such as oil and equipment. These costs are then selected during the course of a fishing trip to keep a running total of the trip expenses and deducted from the trip value before the share settlement is calculated.

Costs that are set up and registered in this manner do not follow through to the inventory record when the trip is landed and catch is posted into inventory. They can, however, be applied as a deduction from the sales value of the catch and will, therefore, affect fishing crew share settlement.

-

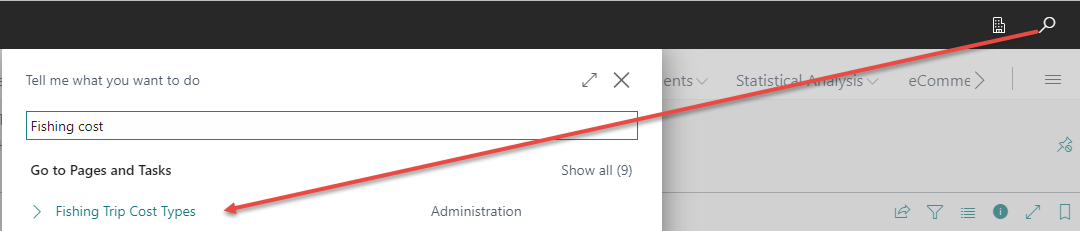

Search for Fishing Trip Cost Types or click on Setup > Fishing Trip Cost Types in the Role Center

-

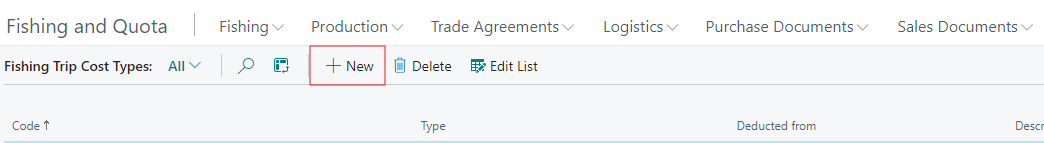

Click New to add a new record

-

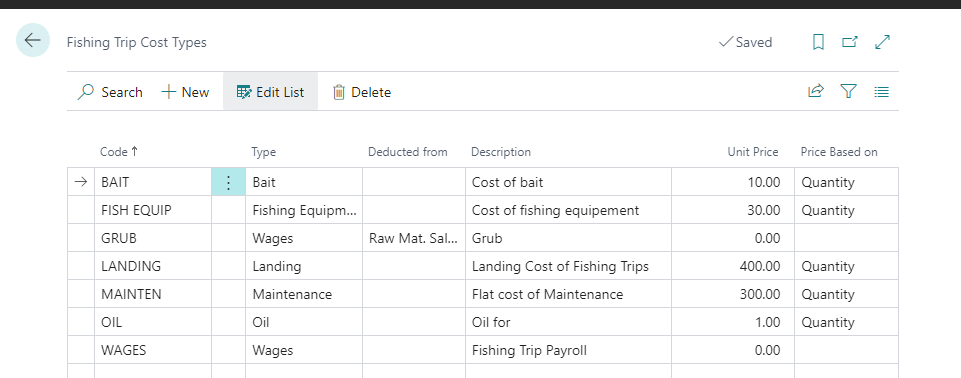

Enter a short Code to identify this Cost Type and a brief description of the cost in the Description field.

-

Select from the Type drop-down list whether the cost is associated with:

-

Wages

-

Landing

-

Oil

-

Fishing Equipment

-

Maintenance

-

Bait

-

-

Choose the method the cost will be Deducted from: Sales Value, Raw Material Sales Value or Product Sales Value if the cost is to be Deducted From the Sales Value posted for the trip. These options will not affect the sales value of the catch. It will deduct the amount from the sales value and post the difference to the Exchange Value when the costs are allocated. This will effect the catch value used to calculate compensation when computing the fishing crew share value for the catch.

-

Set a Unit Price for this cost and select from the Price Based On field if the unit price is to be calculated based on quantity or value.

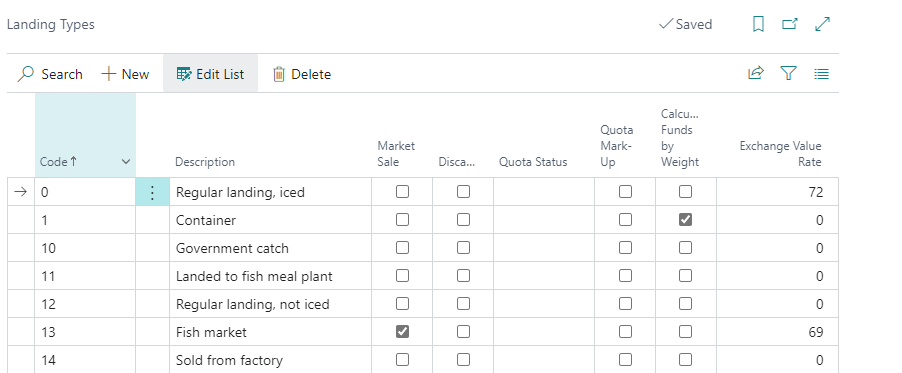

Landing Types

Landing types set some additional parameters surrounding the landing of a Fishing Trip and are (as a field option) specified at the time the catch is recorded and/or if the catch is sold via the fishing module. The Landing Type can determine additional Quota calculations. For example, in some countries, if a catch is sold directly abroad and not landed at the port of vessel registration, then an extra percentage of quota must be deducted.

-

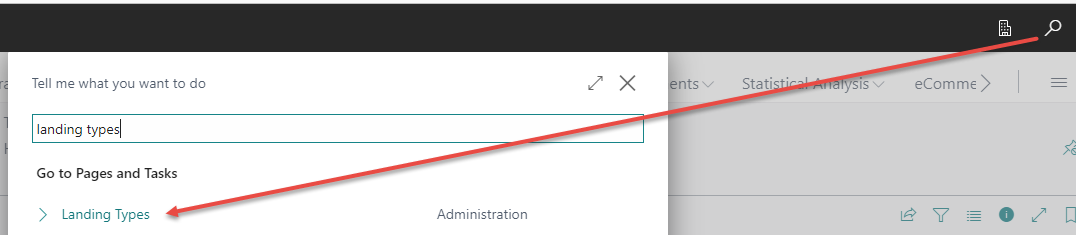

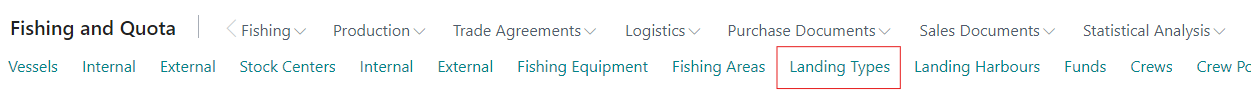

Search for Landing Types or select it from the navigation bar in the Role center

-

Click New if you need to create a new Landing Type

-

Enter a Code and a descriptive Name to identify this Landing Type.

-

The Quota Status field has two options: Exempt and Dir. of Fisheries Quota. When a catch is landed and a landing type of exempt is chosen, the catch will be excluded from the quota (in the case of discarded catch, for example. See field below). In case Dir. of Fisheries Quota is chosen, the quota for this catch will be calculated and applied to the government quota portion (indicated on the quota year card).

-

When the Quota Markup field is checked, landing premiums will be calculated for this landing type.

-

When the Discarded field is check marked, then the catch associated with this landing will be deemed to be unusable (ruined or otherwise not allowed to be sold).

-

In case the Market Sale field is checked, the fish will be considered reserved for sale and will not be placed in inventory when the trip is landed, for a catch line with this Landing Type.

-

Check Calculate Funds by Weight vessel when funds are to be calculated based upon the weight of the catch in this landing type.

-

Set the Exchange Value Rate to determine the ratio to be used in calculating the Fishing Crew Share Settlement. For example, if oil is to be deducted as a fixed expense from the catch value before the general share percentages are calculated, enter the percentage value of the deduction here.